UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| |

| ¨ | Preliminary Proxy Statement |

| | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| x | Definitive Proxy Statement |

| | |

| ¨ | Definitive Additional Materials |

| | |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

Boston Private Financial Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

|

| | |

| x | No fee required. |

| | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11(Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | |

| ¨ | Fee paid previously with preliminary materials. |

| | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

BOSTON PRIVATE FINANCIAL HOLDINGS, INC.

Ten Post Office Square

Boston, Massachusetts 02109

Dear Fellow Shareholders:

On behalf of the Board of Directors and the management of Boston Private Financial Holdings, Inc. (the “Company”), you are invited to attend the Company’s 20162019 Annual Meeting of Shareholders.Shareholders (the “Meeting”). The meetingMeeting will be held on Thursday, April 21, 201618, 2019 at 10:00 a.m., Eastern time,Time, at Ten Post Office Square, 2nd Floor, Boston, Massachusetts 02109.

The attached Notice of the 20162019 Annual Meeting of Shareholders and Proxy Statement describe the formal business to be conducted at the meeting.Meeting. Please refer to the Proxy Statement for detailed information on each of the proposals. Only shareholders of record at the close of business on March 3, 20161, 2019 may vote at the meetingMeeting or any postponements or adjournments of the meeting.Meeting.

On behalf of the Board of Directors and all employees of Boston Private Financial Holdings, Inc., I thank you for your continued support of our Company.

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the 20162019 Annual Meeting of Shareholders, please vote in order to ensure the presence of a quorum.

|

|

| |

| Sincerely, |

|

/s/ CLAYTON G. DEUTSCH

|

Clayton G. DeutschAnthony DeChellis |

| Chief Executive Officer and President |

| |

| Boston, Massachusetts |

Dated: March 17, 201614, 2019 |

BOSTON PRIVATE FINANCIAL HOLDINGS, INC.

Ten Post Office Square

Boston, Massachusetts 02109

NOTICE OF 20162019 ANNUAL MEETING OF SHAREHOLDERS

|

| | |

TIME AND DATE PLACE

| | 10:00 a.m., Eastern Time, Thursday, April 21, 2016

18, 2019 |

| PLACE | | Ten Post Office Square, 2nd Floor Boston, Massachusetts 02109 |

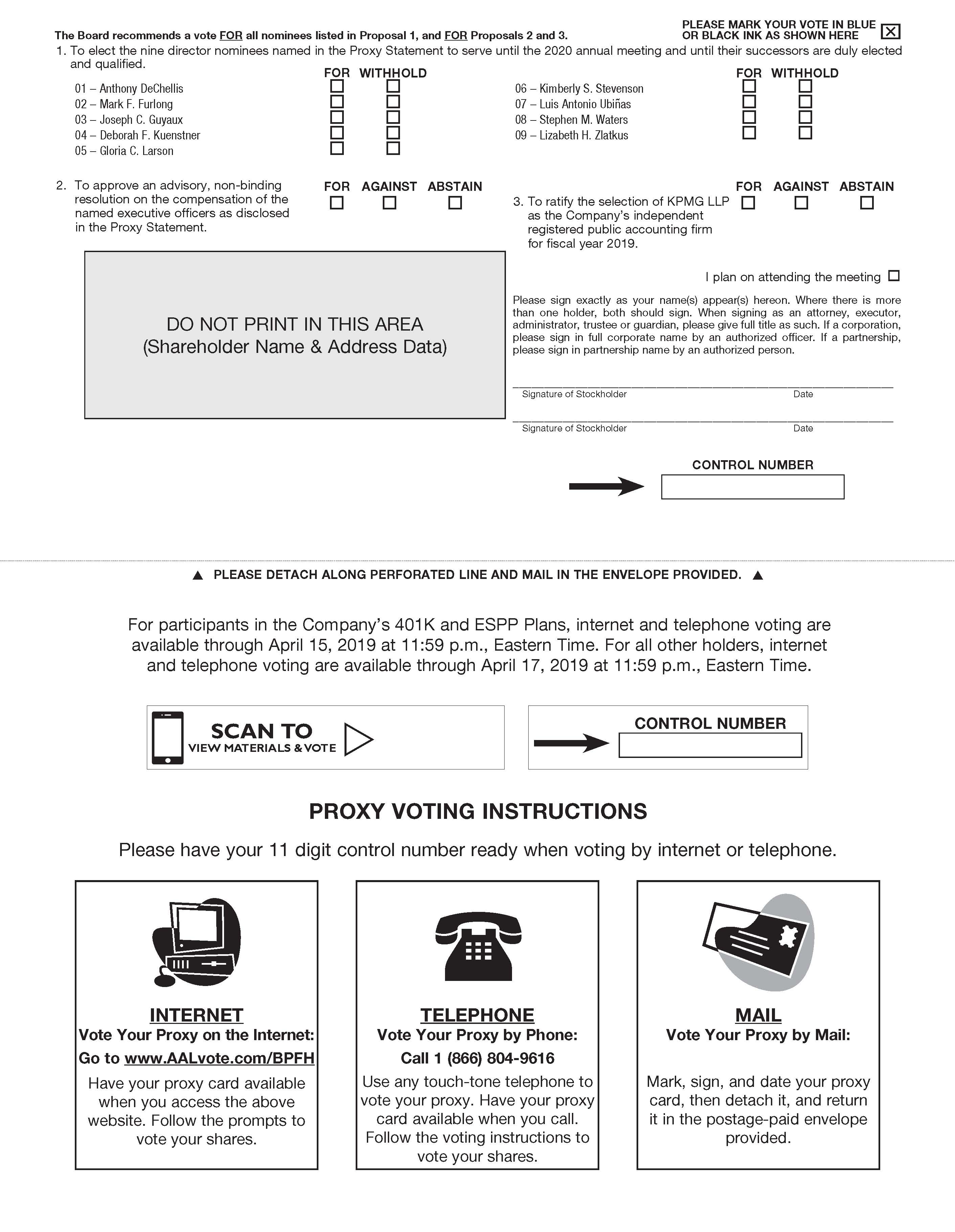

| ITEMS OF BUSINESS | (1) | To elect the nine director nominees named in the Proxy Statement to serve until the 20172020 annual meeting and until their successors are duly elected and qualified. |

| | (2) | To approve an advisory, non-binding resolution on the compensation of the named executive officers as disclosed in the Proxy Statement. |

| | (3) | To approve the Boston Private Financial Holdings, Inc. Annual Executive Incentive Plan. |

| (4) | To ratify the selection of KPMG LLP as the Company’s independent registered public accounting firm for fiscal 2016.year 2019. |

| | (5)(4) | To transact any other business that may properly come before the meeting.Meeting. |

| RECORD DATE | | Only shareholders of record at the close of business on March 3, 20161, 2019 may vote at the meeting or any postponements or adjournments of the meeting.Meeting. |

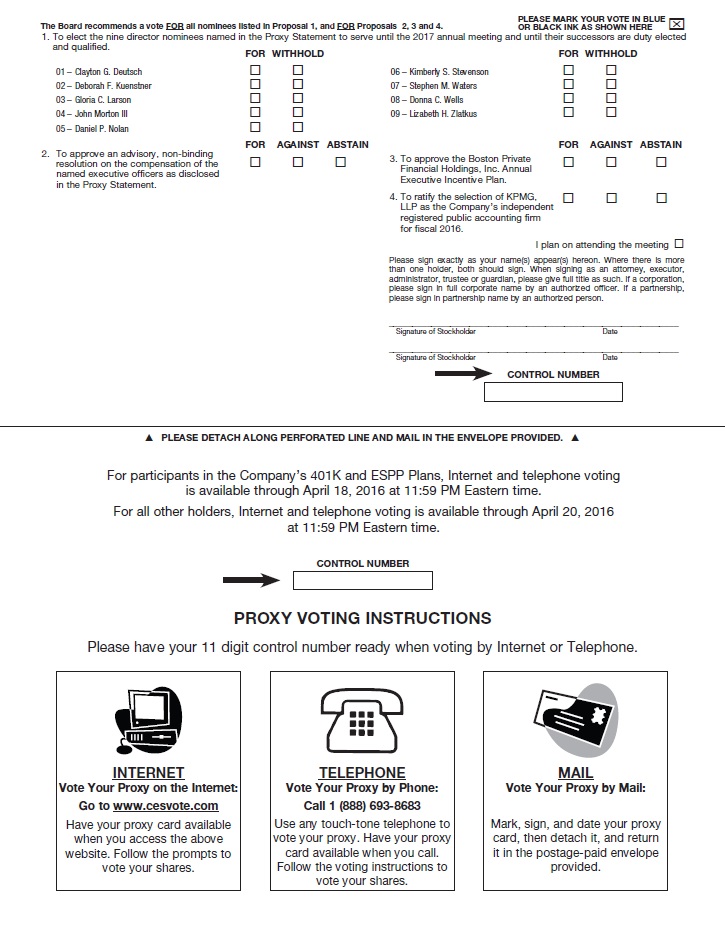

| PROXY VOTING | | Your vote is very important. Please complete, date, sign and return the accompanying proxy card or vote electronically via the Internetinternet or by telephone. The enclosed return envelope requires no additional postage if mailed in the United States. For specific instructions on how to vote your shares, please refer to the section in the Proxy Statement entitled “Voting Options.” |

We look forward to your attendance in person or by proxy.

By Order of the Board of Directors,

MARGARET W. CHAMBERS

CHRISTOPHER A. COOPER

Corporate Secretary

Boston, Massachusetts

Dated: March 17, 201614, 2019

Important Notice Regarding the Availability of Proxy Materials for the 2016 Annual Meeting of Shareholders to be held on Thursday, April 21, 2016.18, 2019. The Company’sProxy Statement and our 2018 Annual Report on Form 10-K for the period ending December 31, 2015 and the 2016 Proxy Statement are available atat: http://www.viewproxy.com/bostonprivate/2016. These documents are also available free of charge by calling the Company’s toll-free number (888) 666-1363 or by contacting the Company’s investor relations department by email at investor-relations@bostonprivate.com.2019

TABLE OF CONTENTS

PROXY STATEMENT

for the

20162019 ANNUAL MEETING OF SHAREHOLDERS

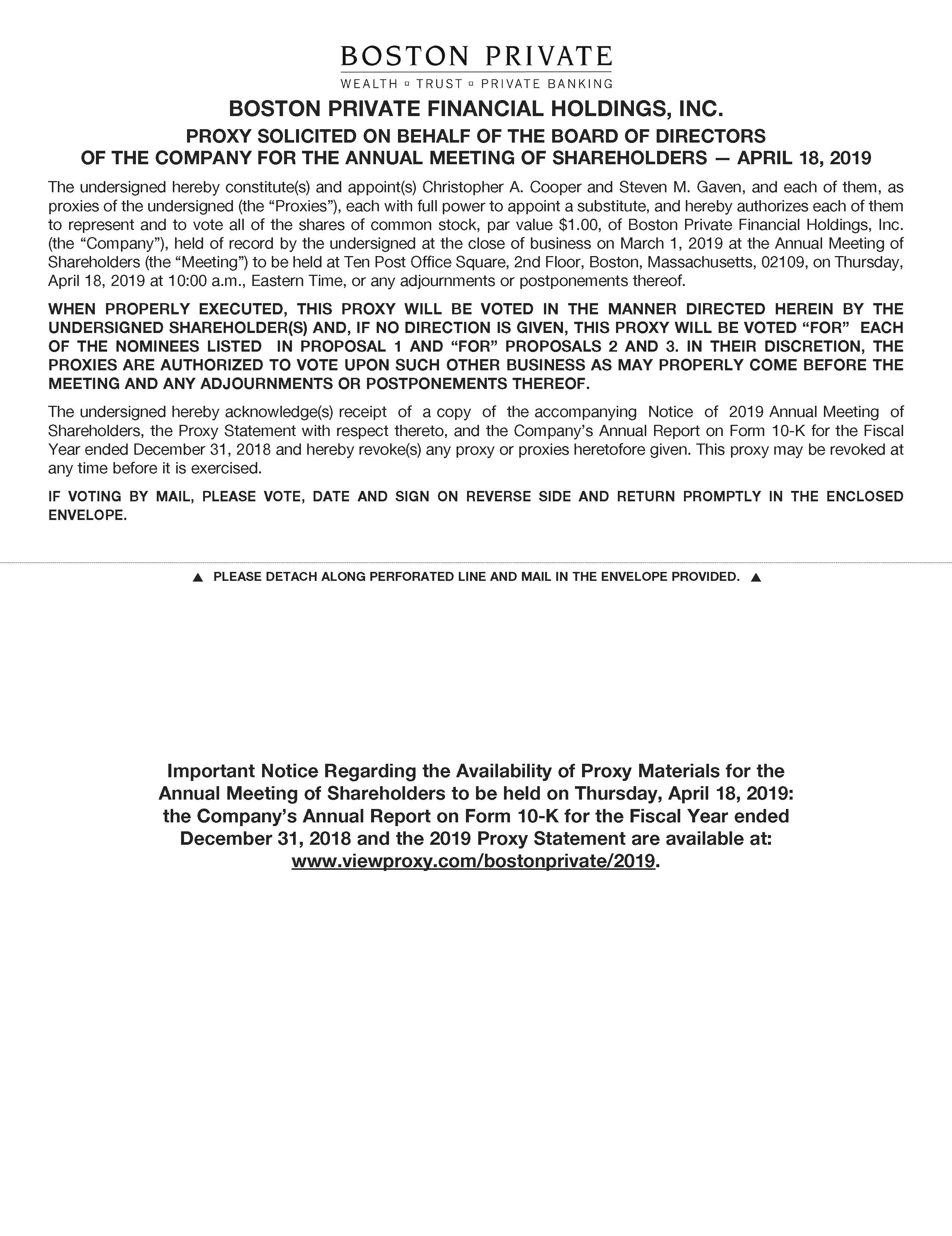

The Company’s Board of Directors (the “Board”) is making this Proxy Statement available to you in connection with the solicitation of proxies by our Board for the 20162019 Annual Meeting of Shareholders (the “Meeting”). The Meeting will be held on Thursday, April 21, 201618, 2019 at 10:00 a.m., Eastern time,Time, at Ten Post Office Square, 2nd Floor, Boston, Massachusetts 02109.

VOTING INFORMATION

Record Date. The record date for the Meeting is March 3, 20161, 2019 (the “Record Date”). At the close of business on the Record Date, there were 83,566,24983,767,232 shares of the Company’s common stock entitled to be voted at the Meeting, and there were 1,042 878

shareholders of record. There are no other outstanding shares that are eligible to vote.

Voting Your Proxy. Only shareholders of record at the close of business on the Record Date are entitled to vote at the Meeting. Each outstanding share of common stock is entitled to one vote on each matter before the Meeting.

Vote Required. A quorum of the common stock must be present at the Meeting for any business to be conducted. The presence, in person or by proxy, of the holders of at least a majority of the votes entitled to be cast on a matter for each voting group constitutes a quorum. Abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present. If a quorum is not present, the Meeting will be adjourned until a quorum is obtained.

DirectorBecause the number of director nominees is not greater than the number of directors that shareholders will be asked to elect, each director nominee must receive the affirmative vote of a pluralitymajority of the votes cast as to such nominee by shareholders in order to be elected. A proxy vote that withholds authority to vote for a particular nominee or nomineesAbstentions and broker non-votes will have no effect on the outcome of the election of the nominees.

The approval of the advisory, non-binding resolution on executive compensation requires the affirmative vote of a majority of the votes cast at the Meeting. Abstentions and broker non-votes will have no effect on the outcome of the votesvote for this proposal.

The approvalratification of the selection of the Company’s Annual Executive Incentive Planindependent registered public accounting firm requires the affirmative vote of a majority of the votes cast at the Meeting. Abstentions and broker non-votes will have no effect on the outcome of the votesvote for this proposal. The ratification of the selection of the Company’s registered independent public accounting firm requires the affirmative vote of a majority of the votes cast at the Meeting.

We are first sending this Proxy Statement and the accompanying materials to shareholders on or about March 17, 2016.14, 2019.

VOTING OPTIONS

Your vote is very important. Even if you plan to attend the Meeting in person, please cast your vote as soon as possible by:

Mail. The accompanying proxy card, if properly completed, signed, dated and returned in the enclosed envelope, will be voted in accordance with your instructions. The enclosed envelope requires no additional postage if mailed in the United States.

Telephone or Internet. If you hold your shares of common stock directly and not in street name, you may vote by telephone or Internetinternet by following the instructions included on your proxy card. If you vote by telephone or Internet,internet, you do not have to mail in your proxy card. Telephone and Internetinternet voting are available 24 hours a day. For participants in the Company’s 401K and ESPP Plans, Internettelephone and telephoneinternet voting isare available through April 18, 201615, 2019 at 11:59 p.m., Eastern time.Time. For all other holders, Internettelephone and telephoneinternet voting isare available through April 20, 201617, 2019 at 11:59 p.m., Eastern time.Time.

Voting in Person at the Meeting. If you are a registered shareholder as of the Record Date and attend the Meeting, you may deliver your completed proxy card in person. Additionally, we will have ballots available for those registered shareholders as of the Record Date who wish to vote in person at the Meeting.

A shareholder of record may revoke a proxy any time before the polls close by submitting a later dated vote by telephone, Internet,internet, or mail, by delivering instruments to the Corporate Secretary before the Meeting or by appearing in person at the Meeting and specifically withdrawing any previously voted proxy.

VOTING MATTERS AND VOTING RECOMMENDATIONS

By submitting your proxy by one of the methods listed above, you authorize Margaret W. Chambers, ExecutiveChristopher A. Cooper, Senior Vice President, Acting General Counsel and Corporate Secretary, and David J. Kaye,Steven M. Gaven, Executive Vice President and Chief Financial and Administrative Officer (collectively, the “Proxy Holders”), to represent you and vote your shares at the Meeting in accordance with your instructions. If a properly executed proxy is submitted and no instructions are given, the proxy will be voted in accordance with the Board’s recommendations as follows:

|

| | | | | |

| Proposal | | | Board Recommendation | | Page Reference (for more detail) |

| Item 1 | Elect the nine director nominees named in this Proxy Statement to serve until the 20172020 annual meeting of shareholders and until their successors are duly elected and qualified. | | FOR each Director Nominee | | |

| Item 2 | Approve an advisory, non-binding resolution on the compensation of the Company’s named executive officers. | | FOR | | |

| Item 3 | Approve the Company’s Annual Executive Incentive Plan. | | FOR | | |

Item 4 | Ratify the selection of KPMG LLP as the Company’s independent registered public accounting firm for fiscal 2016.year 2019. | | FOR | | |

OTHER MATTERS

As of the date of this Proxy Statement, the Board of Directors is not aware of any other matters to be considered at the Meeting. If any other matters properly come before the Meeting, the proxies will be voted at the discretion of the proxy holders.Proxy Holders.

ANNUAL REPORT

All shareholders of record are being sent a copy of the Company’s 20152018 Annual Report to Shareholders and the Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which2018 (which contains audited financial statements of the Company for the fiscal years ended December 31, 2015, 20142018, 2017 and 2013,2016), as filed with the Securities and Exchange Commission (“SEC”) on February 26, 2016.27, 2019. These reports, however, are not part of the proxy soliciting material.

A copy of the Company’s Annual Report on Form 10-K filed with the SEC (our “Annual Report”), including all exhibits, may be obtained free of charge by writing to Boston Private Financial Holdings, Inc., Ten Post Office Square, Boston, Massachusetts 02109, Attention: Corporate Secretary,Investor Relations, or by accessing the Company’s website at www.bostonprivatefinancial.comwww.bostonprivate.com, and selecting the link “Documents/SEC filings” under the “Investor Relations” tab.link at the bottom of the page, and then selecting “Annual Reports” under “Financial Information.” [

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors of the Company currently consists of tennine members. On March 8, 2016,November 5, 2018, the Company announced the resignation of Clayton G. Deutsch as Chief Executive Officer and President of the Company and as a member of the Board of Directors, effective as of November 26, 2018, and the appointment of Anthony DeChellis as Mr. Shapiro informedDeutsch's successor. On February 14, 2019, Daniel P. Nolan resigned from the Board of Directors of the Company that he had decidedCompany. His decision to resign was not to stand for re-election at the Meeting. result of any disagreement with management or the Board of Directors.

At this year’s annual meeting,the Meeting, shareholders will be asked to elect nine directors, each of whom is currently serving as a director of the Company. Each of the nine director nominees has consented to serve as a director if elected at this year’s annual meeting.the Meeting. Each nominee elected as a director will serve until the next annual meeting and until his or her successor has been duly elected and qualified. If any nominee is unable to serve as a director at the annual meeting,Meeting, the Board may reduce the number of directors to be elected at the annual meeting.Meeting.

At the Meeting, because the number of director nominees is not greater than the number of directors that shareholders will be asked to elect, director nominees must receive a majority of the votes cast as to such nominee by shareholders in order to be elected.

The biographical description below for each nominee includes the specific experience, qualifications, attributes and skills that led to the conclusion by the Board of Directors that such person shouldwould be a good candidate to serve as a Directordirector of the Company. In addition to the information presented below regarding each Director’sdirector’s specific experience, qualifications, attributes and skills, the Board also believes that all of the Directorsdirectors have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment to service to the Company.

The Board has determined that each nominee, except Mr. Deutsch,DeChellis, qualifies as an independent director under the NASDAQ listing standards.

If any of the nominees shall become unavailable for any reason, all proxies will be voted FOR the election of such other person as the Board of Directors may nominate and recommend.

The Board of Directors unanimously recommends a vote FOR each of its nine director nominees.

INFORMATION REGARDING DIRECTOR NOMINEESInformation Regarding Director Nominees

The following table sets forth certain information regarding the nominees for election at the 2016 Annual Meeting, of Shareholders, based on information furnished by them to the Company:

| | | | Age | | Director Since | | Independent | Age | | Director Since | | Independent |

| Board Nominees | | | | | | | | | | |

| Clayton G. Deutsch | 60 | | 2010 | | NO | |

| Anthony DeChellis | | 56 | | 2018 | | NO |

| Mark F. Furlong | | 61 | | 2016 | | YES |

| Joseph C. Guyaux | | 68 | | 2016 | | YES |

| Deborah F. Kuenstner | 57 | | 2007 | | YES | 60 | | 2007 | | YES |

| Gloria C. Larson | 65 | | 2015 | | YES | 68 | | 2015 | | YES |

| John Morton III | 72 | | 2008 | | YES | |

| Daniel P. Nolan | 63 | | 2014 | | YES | |

| Kimberly S. Stevenson | 53 | | 2015 | | YES | 56 | | 2015 | | YES |

| Stephen M. Waters, Chairman of the Board | 69 | | 2004 | | YES | |

| Donna C. Wells | 54 | | 2014 | | YES | |

| Luis Antonio Ubiñas | | 56 | | 2017 | | YES |

| Stephen M. Waters, Chair of the Board | | 72 | | 2004 | | YES |

| Lizabeth H. Zlatkus | 57 | | 2015 | | YES | 60 | | 2015 | | YES |

| | | |

Director Nominee Qualifications

This section provides information as of the date of this Proxy Statement about each nominee standing for re-election at the Meeting. It is expected that each nominee, if elected, will also be appointed to the board of directors of Boston Private Bank & Trust Company (the “Bank”), a wholly-owned subsidiary of the Company. Each nominee is currently a member of the board of directors of the Bank. For more information see “Corporate Governance.”

Clayton G. DeutschAnthony DeChellis

Mr. DeutschDeChellis is the Chief Executive Officer and President of the Company which heand the Bank. He joined the Company and was elected to the Board in August 2010.November 2018. Mr. Deutsch is a member of the Company’s Leadership Team andDeChellis has over 30 years of experience in the financial services industry. He began his career in banking in the 1970s at Society Corporation, the predecessor to Key Corp. Prior to joining the Company, he was the President of OurCrowd Venture Capital from 2014 to 2016, where he developed the firm’s business strategy for an equity capital crowdfunding platform, established a director at McKinseydeal flow process to review hundreds of company investment opportunities each year and initiated the development of a new website to engage and manage client relationships. From 2006 to 2013, Mr. DeChellis was the CEO of Credit Suisse Private Banking - Americas. In this role, he provided executive leadership for Credit Suisse’s Private Banking & Company, which he joinedWealth Management businesses in 1980,North and South America and served as Global Leader of that firm’s Merger Management Practice. During his time at McKinsey, he developed deep experience working with many leading financial institutions, with a particular focus in the private banking, wealth advisory, and wealth management sectors, as he helped establish and build McKinsey’s Financial Services practice globally. As a senior leader at McKinsey, Mr. Deutsch managed the Midwest complex of McKinsey offices including Chicago, Pittsburgh, Minneapolis, Cleveland and Detroit, and founded and led the Great Lakes Financial Services practice. Throughout his career with McKinsey, he consulted with financial services providers and other businesses on global strategy development, performance improvement, M&A strategy and corporate governance, among other areas. Mr. Deutsch also served as Chairman of McKinsey’s Principal Review Committee, a member of the Director ReviewCS Global Private Banking Management Committee, the Board of Directors for Credit Suisse Securities USA, LLC, the firm's Private Banking Global Risk Management Committee, the firm’s Global Diversity Committee and the CS Global Investment Banking Management Committee. From 2003 to 2006, Mr. DeChellis was the Head of UBS Private Wealth Management. During his tenure at UBS, Mr. DeChellis launched the Private Wealth Management business for UBS in the United States and oversaw the expansion of services catering to ultra-high net worth clients. He was a long-time member of the ShareholdersUBS Americas Management Council (McKinsey’sand the UBS Global Private Banking Leadership Group. Prior to joining UBS, from 1987 to 2003, Mr. DeChellis held various positions at Merrill Lynch, including Head of International Private Banking for Merrill Lynch Europe. Mr. DeChellis is a member of the Board of Trustees of The Berkshire School, the Board of Directors of The Open Door Homeless Shelter and the President’s Leadership Council of Rollins College. He serves as a member of the board of directors) and Chairdirectors of each of the Professional Standards Committee.Company's operating subsidiaries. In addition to Mr. Deutsch’sDeChellis’ management expertise, he brings to our Board extensive knowledge of financial services strategies. His skills at directing corporate strategy provide our Board with a valuable resourceprivate banking and wealth management strategies as the Company expands its strategic direction. direction, making him an excellent nominee for the Board.

Mark F. Furlong

Mr. Deutsch’sFurlong retired as President and Chief Executive Officer of BMO Harris Bank, N.A. in 2015, a role he assumed upon the acquisition of Marshall & Ilsley Corporation by BMO Financial Group in 2011. He joined Marshall & Ilsley in 2001 as Chief Financial Officer, was elected President in 2004, Chief Executive Officer in 2007, and Chair in 2010. Prior to joining Marshall & Ilsley, he was Chief Financial Officer of Old Kent Financial Corp.; First Vice President, Corporate Development, for H. F. Ahmanson & Company; a partner for Deloitte; and a manager for KPMG LLP. Mr. Furlong also is a member of the boards of directors of Kforce Inc., Antares Capital and Heska Corporation. Mr. Furlong is the immediate past-Chair of Chicago United, the largest Chicago-based organization focused solely on businesses, addressing diversity in boards of directors, management, and supplier relationships. He is a board member of Common Ground Foundation, a group that works with high school students

from under-served communities to become future leaders; Chicago Board of Education; Chicago Teachers’ Pension Fund; Northwestern Memorial Hospital Finance Committee; and the Northwestern Memorial Foundation. He is the founding and immediate past-Chair of LEAP Innovations. During his tenure in Milwaukee, Mr. Furlong was involved in numerous civic activities, including the roles of Chair of both Junior Achievement of Wisconsin and Schools That Can Milwaukee, and a member of the boards of directors of United Way of Greater Milwaukee, Wisconsin Manufacturers and Commerce, Froedtert Health, and the United Performing Arts Fund. Mr. Furlong brings unique insight to the Board concerning capital allocation strategies and banking issues, in addition to his overall management, auditing and financial expertise. With his significant experience in the banking industry, as well as his background as a chief executive officer, the Company believes Mr. Furlong is a highly qualified candidate for the Board.

Joseph C. Guyaux

Mr. Guyaux retired in 2016 from PNC Financial Services Group, Inc., where he worked for 44 years and served as President from 2002 to 2012. In this role, Mr. Guyaux was head of Retail Banking, responsible for leading all of PNC Bank’s (a subsidiary of PNC Financial Services Group) consumer businesses, including consumer and business banking, wealth management and brokerage. Mr. Guyaux held several other senior leadership positions at PNC Financial Services Group, including Chief Risk Officer from 2012 to 2015. Most recently, Mr. Guyaux served as President and CEO of PNC Mortgage, a division of PNC Bank, from 2015 to 2016. Mr. Guyaux is Chair of the boards of directors of DQE Holdings, LLC, Duquesne Light Company and Highmark Health, Inc. He is also Lead Director of Highmark, Inc. and a director of AHN Health Network and Visionworks, Inc., each a subsidiary of Highmark Health, Inc. He serves as a Life Trustee for Carnegie Museums of Pittsburgh and as a director emeritus for the Civic Light Opera and Duquesne University. The Company believes that Mr. Guyaux’s extensive experience in the financial services industry and deep strategichis risk management expertise make him an excellent nominee for the Board.

Deborah F. Kuenstner

Ms. Kuenstner is the Chief Investment Officer of Wellesley College. Before joining Wellesley College in February of 2009, Ms. Kuenstner was Chief Investment Officer and Vice President of Investment Management at Brandeis University from 2007 to January 2009. Prior to working at Brandeis, Ms. Kuenstner was Managing Director of Research for Fidelity Management & Research Company, the investment management organization of Fidelity Investments.Investments, from 2005 to 2006. Ms. Kuenstner was the Chief Investment Officer, Global Value, at Putnam Investments from 2000 to 2004. Her other roles at Putnam included Chief Investment Officer, International Value, and Senior Portfolio Manager, International Equities. Prior to that, she worked at DuPont Pension Fund Investment in Wilmington, Delaware as a Senior Portfolio Manager, International Equities. Ms. Kuenstner has also been a Vice President, International Investment Strategist, at Merrill Lynch, in addition to an Economist at the Federal Reserve Bank of New York. Ms. Kuenstner was actively involved in the Board of Pensions of the Presbyterian Church USA from 1996-2004 as Investment Committee Chair Director, and most recently, Co-opted Director.a director, until becoming a co-opted director. Ms. Kuenstner brings to the Board valuable

experience and knowledge about the financial services industry generally and, in particular, the investment management arena. Along with this experience, herMs. Kuenstner's economic and risk management expertise make her an excellent nominee for the Board.

Gloria C. Larson

Ms. Larson was elected tocurrently serves as President in Residence of the BoardHarvard Graduate School of Education. Until her retirement in January 2015. She has2018, Ms. Larson served as the President of Bentley University since July 2007 and iswas the first woman to hold this position. Ms. Larson formerly served as the Co-Chair of the Government Strategies Group at the law firm of Foley Hoag LLP and from 1996 until 2007 and managed a practice that covered a broad array of federal, state and local regulatory and business development issues. Widely influential in economic policy, Ms. Larson was Secretary of Economic Affairs for The Commonwealth of Massachusetts from 1993 to 1996 and was responsible for developing and promoting economic growth policies and fostering employment opportunities. She served as The Commonwealth of Massachusetts Secretary of Consumer Affairs and Business Regulation from 1991 to 1993, where she was responsible for regulatory oversight of banking, insurance and energy, as well as consumer protection. Prior to her state service, she oversaw business and regulatory issues at the federal level as a senior official with the Federal Trade Commission (FTC), where she served as Deputy Director of Consumer Protection from 1990 to 1991 and as Attorney Advisor to Commissioner Patricia P. Bailey from 1981 to 1988. Ms. Larson has been honored and recognized by many groups for her contributions to state economic development policy and her commitment to civic engagement. Ms. Larson previously served as a member of the Council of Economic Advisors, as well as the Massachusetts Clean Energy Center and the Commonwealth’s Successful Women, Successful Families Task Force. Ms. Larson has served as a member of the Liberal Education and America’s Promise (LEAP) Presidents’ Trust and is a former member of the Executive Committee of the American College and University Presidents Climate Commitment and a member of the Liberal Education and America’s Promise (LEAP) Presidents’ Trust.Commitment. She served for more than a decade as ChairmanChair of the Massachusetts Convention Center Authority (MCCA), and was the first woman to serve as ChairmanChair of the Greater Boston Chamber of Commerce, where she continues to serve on the Chamber’s Executive Committee. Ms. Larson presently holds the post of President of the Massachusetts Conference for Women. In addition, she is a board or advisory council member of several prominent professional, charitable and civic organizations. In addition to serving on the Company’s Board of Directors, Ms. Larson currently serves as a Directoron the board of Unum

Group, chairing Unum’s Regulatory ComplianceGovernance Committee. She was recently elected to the McLean Hospital Board of Trustees. Ms. Larson previously served as a director on the boards of KeySpan Energy and RSA Security, as well as a member of the board of Blue Cross Blue Shield of MA.Massachusetts. Ms. Larson’s deep ties in the BostonMassachusetts community, as well as her expertise in public company matters, and in the regulatory oversight of banking and the financial sector experience, are ofservices industry bring great value to the Board’s oversight and guidance of the Company as it continues to focus on its strategic goal of becoming a premier nationalbanking, wealth management and private bankingtrust company. We believe that Ms. Larson’s expertise in the regulatory oversight of banking and the financial services industry, and her experience managing regulatory and business development issues qualify her as an excellent nominee for the Board.

John Morton III

Mr. Morton is a seasoned bank executive with over 35 years of banking and financial services experience. He has extensive experience leading organizational turnarounds, acquisition integrations, business growth and corporate governance activities. Mr. Morton was a director of Fortress International Group, Inc. from January 2007, and served as Chairman from December 2008 to January 2012, when he resigned from the board. Mr. Morton served as an advisor to Fortress International Group, Inc.’s board through the first quarter of 2012. He has been a Director of the Company since August 2008, of Barry-Wehmiller Companies, Inc. since July 2007, and Dynamac International Inc., from the late 1980s until it was sold in early 2010. Mr. Morton served as a director of Broadwing Corporation from April 2006 to January 2007. He served as President of Premier Banking for Bank of America Corp. from August 2004 to September 2005. From 1997 to 2001, Mr. Morton served as President of the Mid-Atlantic Region, Bank of America. He was President of the Private Client Group of NationsBank from 1996 to 1997. From 1994 to 1996, he served as Chairman, Chief Executive Officer and President of The Boatmen’s National Bank of St. Louis, and as Chief Executive Officer of Farm and Home Financial Corporation from 1992 to 1993. In 1990 and 1991, Mr. Morton served as Perpetual Financial Corporation’s Chairman, Chief Executive Officer and President. He served in the U.S. Navy as a lieutenant aboard the nuclear submarine U.S.S. George Washington Carver. He serves as Commissioner of the Maryland State Lottery and Gaming Control Commission, Director, U.S. Naval Institute, and director of the U.S. Naval Academy Foundation Athletic and Scholarship Programs. We believe Mr. Morton is a valuable nominee for the Board in light of his experience as the chairman, chief executive officer and president of several banking institutions, coupled with his service on a number of public company boards. He brings to the Board operational expertise, a deep background in the financial services industry, and a comprehensive understanding of the Company’s business, all of which make him particularly qualified and an excellent nominee to serve on the Board.

Daniel P. Nolan

Mr. Nolan has served as President and CEO of Hugh Johnson Advisors, LLC, a registered investment advisor located in Albany, New York, since October 2008. Mr. Nolan is also a principal in NPV Capital LLC, a private equity and real estate investment firm that he formed in July 2007. Prior to holding these positions he was a partner in Ayco Company, L.P., a wholly owned subsidiary of Goldman Sachs. During his twenty-eight year career at Ayco, from August 1978 through April 2007, Mr. Nolan provided tax, investment and financial planning advice to Ayco’s highest net worth clients. He served as a Regional Vice President of two of Ayco’s regional offices and held a variety of management positions, serving on both the Senior Management Committee and the Strategic Planning Committee. Mr. Nolan founded and led the firm’s Special Investment Group, creating venture capital, private equity and hedge fund opportunities for the firm’s clients. In July 2003, Ayco was sold to The Goldman Sachs Group and Mr. Nolan led the effort to integrate Ayco into Goldman’s Private Wealth Management practice. He previously served on the board of Capital Bank & Trust, a community bank headquartered in Albany, New York. Mr. Nolan has been a trustee of Albany Law School since May 2011 and a trustee of The College of St. Rose since May 1989. Mr. Nolan has been a member of the board of directors of NSC de Puerto Rico, Inc. since June 1998, a member of the Center for Disability Services Endowment since May 2013, and a member of the College Affairs Committee of the Albany Medical Center Board of Directors since August 2012. Mr. Nolan’s proven business acumen, as demonstrated by his success in founding and leading several companies, is a valuable resource as the Company continues to build on its current strategy. He has significant leadership, operational and investment management and financial expertise. Further, Mr. Nolan offers the Board a unique perspective into a number of important areas including strategic planning and wealth management. We believe that Mr. Nolan’s extensive experience make him an excellent nominee for the Board of Directors.

Kimberly S. Stevenson

Ms. Stevenson is a venture partner at RIDGE-LANE Limited Partners, a strategic advisory and venture development firm. She serves as a fiduciary advisor to companies looking to accelerate growth through the use of technology. Formerly, Ms. Stevenson was electeda Senior Vice President at Lenovo where, during 2018, she led the $5 billion data center group business. She was responsible for the profit and loss statement of all data center products, platforms and software solutions. From September 2009 to the Board in October 2015. She isFebruary 2017, Ms. Stevenson was an executive officer and corporate vice president of Intel Corporation. Her most recent position at Intel was Chief Operating Officer (COO) for Intel’s Client and Internet of Things Businesses and Systems Architecture (CISA) Group. In this role, Ms. Stevenson was responsible for CISA’s operational excellence, strategic planning process and related cross-company coordination. Prior to the COO role, Ms. Stevenson served as Intel’s Chief Information Officer (CIO) of Intel Corporation, which she joined in September 2009. Her IT organization capitalizes on information technology to accelerate Intel’s quest to bring smart, connected devices to every person on Earth. More than 6,000 worldwide IT professionals are protecting Intel’s assets, driving competitive advantage, and providing IT solutions under Ms. Stevenson’s leadership.from 2012 until August 2016. Previously, Ms. Stevenson held the position of vice presidentVice President and general managerGeneral Manager of Intel’s Global IT Operations and Services. Prior to joining Intel, Ms. Stevenson spent seven years at the former EDS,HP Enterprise Services, now HP enterprise services,DXC Technology, holding a variety of positions including vice presidentVice President of its Worldwide Communications, Media and Entertainment (CM&E) Industry Practice, as well as the vice presidentVice President of Enterprise Service Management, where she oversaw the global development and delivery of enterprise services. Before joining EDS, Ms. Stevenson spent 18 years at IBM,HP Enterprise Services, from February 1983 to September 2002, inMs. Stevenson held several executive positions at IBM, including vice presidentVice President of Marketing and Operations of the eServer iSeries division. She currently serves on the board of directors of Cloudera.Skyworks Solutions, Inc. and previously served on the boards of directors of Cloudera and Riverbed Technology until 2017 and 2015, respectively. With the financial services industry increasingly reliant on technology, Ms. Stevenson’s deep operational experience and CIOtechnology experience serve to enhance the Board’s overall makeup and as such make her an excellent nominee to serve oncandidate for the Board of Directors.

Luis Antonio Ubiñas

Mr. Ubiñas is currently President of the Board of Trustees of the Pan American Development Foundation, which invests nearly $100 million annually in development projects in Central and South America and the Caribbean. He also serves on several multilateral, governmental and nonprofit boards and advisory committees, including the Advisory Board of the United Nations Fund for International Partnerships. Mr. Ubiñas is a Trustee and Executive Committee member of the New York Public Library and Vice Chair of the Statue of Liberty-Ellis Island Foundation. In the private sector, Mr. Ubiñas is Lead Director at Electronic Arts, and serves on the boards of directors of GFR Media, the largest media company in Puerto Rico, and Shorelight Education. Mr. Ubiñas previously served as president of the Ford Foundation from 2008 through 2013. The Ford Foundation is the second largest foundation in the United States with an endowment of approximately $12 billion and operates worldwide, with offices in Asia, Africa, and Central and South America. While at the Ford Foundation, he led a broad-based restructuring of the organization, including a strategic resetting of its programs, reinvestment of over 80% of the endowment, and a rebuilding of facilities and systems. Prior to leading the Ford Foundation, Mr. Ubiñas was a Director at McKinsey & Company, leading the firm’s media practice on the West Coast, where he helped technology, telecommunications and media companies develop and implement strategies and improve operations. Much of his work focused on the opportunities and challenges represented by the global growth of broadband and wireless technologies and applications. Mr. Ubiñas is a Fellow of the American Academy of Arts and Sciences and a member of the Council on Foreign Relations. Along with his expertise in governance-related matters, we believe Mr. Ubiñas' deep knowledge in the marketing and media arenas will help the Board guide the Company as it implements a digital transformation and make him an excellent nominee for the Board.

Stephen M. Waters

Mr. Waters is Chairmanthe Chair of the Board of the Company and the board of directors of the Bank, and is Managing Partner of Compass Partners Advisors LLPCapital LLC and its advisory and investment subsidiaries, which hesubsidiaries. He founded Compass Partners in 1996. Prior to this,Previously, Mr. Waters spent over twenty20 years advising corporate and financial entities both in the U.S.United States and internationally. Mr. Waters served from 1992 to 1996 as Co-Chief Executive Officer of Morgan Stanley, Europe, and was a member of Morgan Stanley’s worldwide 12-person Operating Committee. Mr. Waters joined Morgan Stanley as a Managing Director in the Mergers and Acquisitions Department in June 1988 and was Co-Director of that department from January 1990 to early 1992. Mr. Waters was Co-Director of the Mergers and Acquisition Department at Shearson Lehman Brothers from 1985 to 1988. He serves on the Boardboard of Directorsdirectors of Valero Energy Corporation, where he sits on the audit committee. Mr. Waters brings over 3540 years of specific and relevant financial services experience to the Board, along with a deep understanding and practical knowledge of the investment management business. Mr. Waters’His background as a chief executive officer and director, as well as his extensive experience in investment management, economics, and mergers and acquisitions, makes himmake Mr. Waters an excellent nominee for the Board.

Donna C. Wells

Ms. Wells became a member of the Company’s Board of Directors in July 2014. She is currently Board Director, President and CEO of Mindflash Technologies, Inc., a private, Palo Alto, California company providing the market-leading cloud-based platform for employee and customer training. Prior to joining Mindflash in 2010, Ms. Wells had a nearly 20 year career in the financial services industry, including experience leading transitions from offline to online business models within Fortune 1000 companies and successfully disrupting established players with small, start-up teams as a serial entrepreneur. Ms. Wells began her career at American Express in 1989 as a member of the Corporate Strategic Planning group and later held positions of increasing responsibility in that company’s Consumer and Corporate Card businesses. From 1997 to 2000, she helped establish a new, strategic product development function for Charles Schwab’s retail business and ultimately held responsibility for product development and marketing to customer segments representing 70% of all Schwab client households. This early experience with the power and scale afforded by online financial service delivery drove Ms. Wells to leadership roles with three

of the most innovative companies in this space from 2000 through 2009: MyCFO Wealth Management (sold to Harris Bank), Intuit and Mint.com (sold to Intuit). Ms. Wells’ teams’ work has won multiple Webby’s (the “Oscars of the Internet”) and recognition as a Tech Pioneer by the World Economic Forum in Davos. She has been named a Top 25 Women in Tech to Watch by Accenture and a Marketing Executive of the Year Finalist by the Wall Street Journal. Ms. Wells is a native Californian and returned to live in the Bay Area in 1995, following 14 years on the East Coast and in Asia. Ms. Wells’ extensive experience in the financial services industry and her expertise surrounding online financial service delivery qualifies her as an excellent nominee to serve on the Board of Directors.

Lizabeth H. Zlatkus

Ms. Zlatkus became a member of the Company’s Board of Directors in July 2015. Ms. Zlatkus also serves as a Director on the Board of Legal & GeneralUntil her retirement from The Hartford Financial Services Group, (FTSE 100), which she joined in December 2013. She has served on the Pennsylvania State University Business School Board since September 2003 and has served on the Connecticut Science Center Trustee Board since December 2010. Ms. Zlatkus held many senior leadership positions during her tenure at The Hartford Financial Services Group from 1983 to 2011. These roles included her role asboth Chief Financial Officer and Chief Risk Officer of the Firm,Company, as well as Co-President of Hartford Life Insurance Companies. She also previously served as Executive Vice President of two of the largest divisions of the firm, the international operations and the group life and disability divisions. Ms. Zlatkus currently serves as a director on the boards of SE2 Holdings, Inc. and Indivior PLC, will become a member of the board of AXIS Capital Holdings Limited, effective March 15, 2019, and previously served as a director of Legal & General Group, Plc, and Computer Sciences Corporation. She sits on the Pennsylvania State University Business School Board, where she served as Chair from 2012 to 2015, and sits on The Connecticut Science Center Trustee Board, serving on the executive committee. Ms. Zlatkus has been recognized by the White House for her professional achievements and contributions to the community. She was recognized by Hillary Clinton for herprevious work supporting the disability community, in 1999, and during that time participated as a member of The President’s Committee on Employment of People with Disabilities. Ms. ZlatkusShe was the cover feature of CFO magazine, was named one of the top 100 women executives by Business Insurance magazine, named toreceived the Women Worth Watching List by the Profiles in Diversity Journal,Pennsylvania State University Alumni Fellow award, and was named as the Community Leader of the Year by the Cystic Fibrosis Foundation’s Connecticut Chapter. Ms. Zlatkus served as Regulatory Chair for the North American Chief Risk Officers Council. She was a member on the Hewlett Packard Financial Services Board of Advisors, the LOMA Boardboard of Directors,directors, and a Trustee of the Connecticut Women’s Hall of Fame. Ms. Zlatkus was selected as an Alumni Fellow of The Pennsylvania State University in 2003 and served as the commencement speaker for the business school in 2013. Ms. Zlatkus’sZlatkus’ extensive experience in the financial services arena, where she has deep expertise in risk and finance, regulation, governance, and operations,, makes her an excellent nominee for the Board.

CORPORATE GOVERNANCE

The business of the Company is managed under the direction of the Company’s Board of Directors in accordance with the Massachusetts General Laws, and the Company’s Restated Articles of Organization, as amended, and by-laws.the Company’s Amended and Restated Bylaws (the "Bylaws"). The Board of Directors provides oversight of the Company’s activities for the benefit of its shareholders and other constituencies, which includesinclude the Company’s regulators, affiliated companies, employees, customers, suppliers, creditors and the communities in which the Company and its affiliates conduct business. The table below lists many of our governance practices.

|

| |

| Board and Other Governance Information |

| Majority Voting for Directors | Yes |

| Annual Election of All Directors | Yes |

| Diverse Board (as to Gender, Composition, Skills, Experience, etc.)* | Yes |

| Annual Board and Committee Self-Evaluation | Yes |

Separate ChairmanChair of the Board and CEO | Yes |

Independent Directors Meet Without Management at Each Regularly Scheduled Board MeetingMeetings | Yes |

| Annual Independent Director Evaluation of CEO | Yes |

| Code of Business Conduct and Ethics for Directors | Yes |

| Board Level Risk Management Committee | Yes |

| Size of Board* | 9 |

| Number of Independent Directors* | 8 |

| Average Director Age* | 6162 |

| Average Director Tenure (in Years)* | 3.85.3 |

| Annual Equity Grant to Directors | Yes |

| Disclosure Committee for Financial Reporting | Yes |

| Director Stock Ownership Policy | Yes |

| Term and Age Limit Guidance for Directors | Yes |

*Based on nominated Boardthe nine director nominees named in this Proxy Statement. | |

Corporate Governance Guidelines

The Board of Directors has a particular focus on corporate governance, developing the strategic direction of the Company, and seeking to ensure the success of the Company’s business through the appointment and retention of qualified executive management. The Board has documented its commitment to serve the best interests of the Company and its shareholders in its Corporate Governance Guidelines which, among other things, describe our most important corporate governance practices and address issues such as director qualification standards, director responsibilities, board composition and structure, performance evaluation and succession planning. Under the Company’s Corporate Governance Guidelines, a director who reaches the age of 74 or a term of 20 years while serving as director is required to offer his or her resignation from the Board of Directors as of the next annual meeting of shareholders.

Board Leadership Structure

In accordance with the Company’s by-laws,Bylaws, the Board of Directors elects the ChairmanChair of the Board and appoints the President, who also serves as Chief Executive Officer (“CEO”). The Board of Directors has adopted a policy that provides for the separation of the roles of ChairmanChair of the Board and Chief Executive Officer.CEO.

The Compensation, Governance and Executive Committee has established a Statement of Roles and Responsibilities (“Statement”) for the non-executive ChairmanChair of the Board of Directors (“non-executive Chair”). The Statement provides that the position of non-executive ChairmanChair may only be held by a member of the Board of Directors who has been determined to be “independent”independent under the NASDAQ listing standards. The non-executive ChairmanChair is elected by the Company’s Board of Directors annually and may be removed at any time with or without cause. The non-executive ChairmanChair is responsible for the management, development and effective functioning of the Board of Directors and provides leadership in every aspect of the Board’s oversight of the Company. The non-executive ChairmanChair acts in an advisory capacity to the CEO and President of the Company, and to other executive officers in matters

concerning the interests of the organization and the Board, as well as serving as the liaison between management and the Board of Directors. The duties of the ChairmanChair of the Board include the following:

setting agendas for the Board meetings in consultation with the CEO;

chairing Board meetings and ensuring that Board functions are effectively carried out;

chairing executive sessions of independent directors and providing feedback to the CEO and President, as appropriate;

serving as liaison for Chairschairs of affiliated company boards, as needed;

facilitating the Board’s efforts to create and maintain practices that respond to feedback from shareholders and other stakeholders;

representing the Board at meetings with major shareholders and other stakeholder groups on governance relatedgovernance-related matters, as may be requested from time to time;

providing advice on behalf of the Board to the CEO and President on major issues;

facilitating effective communication between Directorsdirectors and management, both inside and outside of meetings of the Board;

working with the CEO and President to ensure management strategies, plans and performance are appropriately risk assessed and represented to the Board; and

advising management in the planning of the strategy meeting.

The Compensation, Governance and Executive Committee conducts a periodic review of the role and responsibilities of the non-executive ChairmanChair and this review is then presented to the full Board of Directors.

Board Committee Structure

In January of 2019, the Board of Directors realigned its committee structure to better address the evolving needs of the Company. As a part of this restructuring, the Board of Directors: (1) eliminated the former Growth Initiatives/Trust and Investment Committee (previously known as the Wealth Management/Trust and Investment Committee) and assigned this committee's fiduciary responsibilities relating to the operation of trusts and the administration of fiduciary accounts to the Audit Committee of the Bank; and (2) split the Compensation, Governance and Executive Committee into two separate committees, the Compensation Committee and the Governance and Executive Committee. As a result, the Board of Directors currently has four standing committees: the Audit and Finance Committee; the Compensation Committee; the Governance and Executive Committee; and the Risk Management Committee.

Each committee is comprised solely of members of the Board of Directors who have been determined to meet the definition of independent directors in accordance with NASDAQ listing standards. All committees have adopted charters that provide a statement of the respective committee’s roles and responsibilities. Current charters for the Audit and Finance Committee and the Compensation Committee can be viewed online by accessing the Company’s website at www.bostonprivate.com, selecting the “Investor Relations” link at the bottom of the page, and then selecting “Corporate Governance” under “Governance.”

Risk Oversight

The Board of Directors playsand its committees play an important role in the risk oversight of the Company and is involved in risk oversight throughits management, and exercise direct decision-making authority with respect to significant matters, including the development of limits and specific risk tolerances, and the oversight of management by the Board of Directors and its committees.tolerances. The Board of Directors and its committees also are each directly responsible for considering and overseeing risks and the oversight of risks relating to decisions that each committee is responsible for making.in specified areas. In light of the Company’s overall business and market, the extensive regulatory schemes under which the Company and all of its affiliates operate, and the complexities of the Company’s operations as a whole, the Board has established a Risk Management Committee that is tasked with specific responsibility for direct oversight of all of the risks inherent in the Company’s business, along with management of the enterprise-wide risk management program. The Risk Management Committee consults with each of the other committees of the Board of Directors for an analysis of their areas of risk, as well as with management and outside experts, and provides regular, detailed reporting and recommendations on risk-related actions to the full Board. The Risk Management Committee also monitors the risk management function, and conducts

reviews risk assessments and other risk reporting for all of the Company’s subsidiaries, participates directly in the risk management committee meetings of the Bank, which is the Company’s largest subsidiary,business segments and operations, and adopts and directs the implementation of risk management policies that relate to both the Company and its subsidiaries, and analyzes reporting regardingincluding the same.Bank.

In addition to the Risk Management Committee, the Board of Directors administers its risk oversight function through:

the review and discussion of regular, periodic reports to the Board of Directors and its committees on topics relating to the risks that the Company faces, including, among others, credit risk, market risk, interest rate risk, operational risks (including cybersecurity and technology-related risks), and compliance and regulatory risk;

monitoring the level and trend of such risks relative to pre-approved appetites and the ability to manage and mitigate such risks;

the required approval by the Board of Directors (or a committee thereof) of significant transactions and other decisions, including among others, final budgets, material uses of capital, strategic direction, and executive management hiring and promotions;

the direct oversight of specific areas of the Company’s business by the Risk Management Committee, the Audit and Finance Committee, the Wealth Management/Trust and InvestmentCompensation Committee and the Compensation, Governance and Executive Committee; and

regular periodic reports from the Company’s internal and external auditors and other third party consultants regarding various areas of potential risk, including, among others, those relating to the Company’s internal controls and financial reporting.

The Board of Directors also relies on management to bring significant matters impacting the Company and its subsidiaries to the Board of Directors’ attention.

Risk Review and Analysis of Incentive Compensation Arrangements

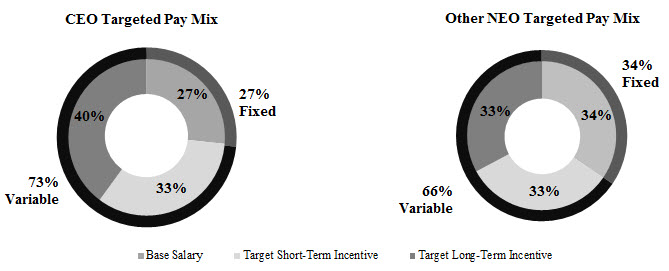

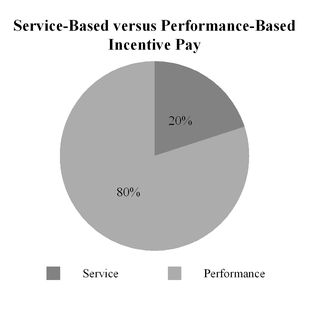

The Company’s compensation program is designed to offer competitive pay for performance, aligning with the Company’s short- and long-term business strategies, risk appetite and shareholder interests. The Board oversees the Company’s incentive compensation programs, primarily though the Compensation Committee, with additional input from the Company’s Chief Risk Officer, and Chief Human Resources Officer, monitorGeneral Counsel, Chief Financial Officer and on a biennial basis, or more frequently as material changes occur, discuss, evaluate and review the Company’s compensation programs. During 2015, no such reviews were conducted or required; a detailed review will be conducted in 2016.Manager of Compensation. The findings of these reviews are presented to the Compensation, Governance and Executive Committee for further evaluation and discussion with particular focus on(the predecessor to the following key areas:current Compensation Committee which was established in January 2019) conducted a detailed review of the Company’s incentive compensation arrangements. This review focused on: (1) the compensation plans of the persons identified as named executive officers (“NEOs”) in this Proxy Statement to ensure that such plans do not encourage the NEOs to take unnecessary or excessive risks that threaten the value of the Company; (2) employee compensation plans in light of the risks posed to the Company by such plans and how to limit these risks; and (3) employee compensation plans to ensure these plans do not encourage the manipulation of reported earnings to enhance compensation. In 2018, the majority of incentive compensation plans reviewed were categorized as low risk. NEO compensation plans are described in detail in “Compensation Discussion and Analysis.” The Compensation Committee has determined to conduct future incentive compensation reviews for the non-Bank segments on a biennial basis, with interim reviews if material changes occur.

The Compensation Governance and Executive Committee’s review focuses on incentive compensation plans as opposed to base salary plans or standard benefit arrangements, as the CompanyCommittee believes that incentive compensation arrangements have the greatest potential to encourage inappropriate risk-taking, and/or encourage the manipulation of earnings to enhance compensation. The Company also believes that its base salary and benefit arrangements are generally reasonable and appropriate, considering the Company’s compensation philosophy and industry and regional differences.

The Compensation, Governance and Executive Committee evaluates each plan using the following risk categories: acceptable to low risk, moderate level of risk, and significant risk/potential for material adverse impact. The majority of the Company’s incentive compensation plans have been rated in the “acceptable to low risk category.” The Company believes appropriate controls are in place to minimize the risk for permittingof unnecessary and inappropriate risk-taking or encouragingas a result of the incentive plans and to discourage the manipulation of earnings to enhance compensation. Such controls include the addition of mechanisms to clawbackclaw back compensation in certain circumstances, enhanced governance processes for compensation reviews and the on-going monitoring of employee compensation that may trigger automaticadditional individual or plan reviews.

The Compensation Governance and Executive Committee believes that the balance of base compensation, variable annual incentive bonuses determined based on Company and individual performance, and long-term equity incentive compensation is weighted such thatto discourage excessive or unnecessary risk taking will not be encouraged by the variable elements of compensation.risk-taking. Further, the Compensation Governance and Executive Committee believes that the long-term equity components of compensation encourage the Company’s executives to focus on elements of the Company’s performance to influence long-term value creation and share price appreciation.

Committees of the Board and Related Matters

The Board of Directors currently has four standing Committees: the Audit and Finance Committee; Compensation, Governance and Executive Committee; Risk Management Committee; and Wealth Management/Trust and Investment Committee. Each committee was comprised solely of members of the Board of Directors who have been determined to meet the definition of “independent” in accordance with the NASDAQ listing standards. All of the committees have adopted charters that provide a statement of the respective committee’s roles and responsibilities. Current charters for the Audit and Finance Committee and the Compensation, Governance and Executive Committee are available in the Investor Relations/Corporate Governance section of the Company’s website at www.bostonprivatefinancial.com.

The following table sets forth membership on the committees that were in place during 2018 and the number of meetings held during 2015.2018.

|

| | | | | | | | |

| Name | | Audit and Finance | | Compensation, Governance and Executive | | Risk Management | | Wealth Management/Trust and Investment Committee |

| Deborah F. Kuenstner (1) | | Ÿ | | Chair (7) | | | | Ÿ |

| Gloria C. Larson (2) | | | | Ÿ | | Ÿ | | |

| John Morton III | | Chair (7) | | | | Ÿ | | |

| Daniel P. Nolan | | | | Ÿ | | | | Chair (7) |

| Brian G. Shapiro (3) | | Ÿ | | | | Chair (7) | | |

| Kimberly S. Stevenson (4) | | | | | | Ÿ | | Ÿ |

| Stephen M. Waters (5) | | | | Ÿ | | | | Ÿ |

| Donna C. Wells | | | | | | Ÿ | | Ÿ |

| Lizabeth H. Zlatkus (6) | | Ÿ | | | | | | Ÿ |

| Number of Committee Meetings Held in 2015 | | 9 | | 12 | | 8 | | 5 |

| | | | | | | | | |

|

| | | | | | | | |

| Name | | Audit and Finance | | Compensation, Governance and Executive (1) | | Risk Management | | Growth Initiatives/Trust and Investment Committee (2) |

| Mark F. Furlong (3), (4), (5) | | Ÿ | | | | | | |

| Joseph C. Guyaux (3) | | | | Ÿ | | Ÿ | | |

| Deborah F. Kuenstner (3), (4), (6) | | | | Chair (10) | | | | |

| Gloria C. Larson (3) | | | | Ÿ | | Ÿ | | |

| Daniel P. Nolan (3), (4), (11) | | Ÿ | | | | | | Ÿ |

| Kimberly S. Stevenson (3), (4) | | | | | | Chair (10) | | Ÿ |

| Luis Antonio Ubiñas (3), (4), (7) | | Ÿ | | | | | | Chair (10) |

| Stephen M. Waters (3), (4). (8) | | | | Ÿ | | | | |

| Lizabeth H. Zlatkus (3), (4), (9) | | Chair (10) | | | | | | |

| Number of Committee Meetings Held in 2018 | | 9 | | 8 | | 8 | | 7 |

| | | | | | | | | |

| |

| (1) | In January of 2019, the Board of Directors split the Compensation, Governance and Executive Committee into two separate committees, the Compensation Committee and the Governance and Executive Committee. |

| |

| (2) | In April of 2018, the former Wealth Management/Trust and Investment Committee became the Growth Initiatives/Trust and Investment Committee. In January of 2019, the Board of Directors eliminated the Growth Initiatives/Trust and Investment Committee. |

| |

| (3) | Our Board of Directors has determined that this member meets the definition of an independent director under NASDAQ listing standards. |

| |

| (4) | Our Board of Directors has determined that this member meets the definition of an “audit committee financial expert” under SEC regulations. |

| |

| (5) | Mark F. Furlong left the Growth Initiatives/Trust and Investment Committee as of April 2018. |

| |

| (6) | Deborah F. Kuenstner joinedleft the Audit and Finance Committee as of April 2015.2018. |

| |

(2)(7) | Gloria C. Larson joined the Board of Directors,Luis Antonio Ubiñas left the Compensation, Governance, and Executive Committee and the Risk Management Committee as of January 2015. |

| |

(3) | In March of 2016, Mr. Shapiro informed the Board of Directors of the Company that he would not stand for re-election at the Meeting. |

| |

(4) | Kimberly S. StevensonApril 2018 and joined the Board of Directors, the Risk ManagementAudit and Finance Committee and the Wealth Management/Trust and Investment Committee as of October 2015. |

| |

(5) | Stephen M. Waters joined the Wealth Management/Growth Initiatives/Trust and Investment Committee as of April 2015.2018. |

| |

(6)(8) | Lizabeth H. Zlatkus joinedStephen M. Waters left the Board of Directors, the Audit and Finance Committee, and the Wealth Management/Growth Initiatives/Trust and Investment Committee as of July 2015.April 2018. |

| |

(7)(9) | Lizabeth H. Zlatkus left the Compensation, Governance, and Executive Committee as of April 2018. |

| |

| (10) | Indicates Chair as of December 31, 2015.2018. |

| |

| (11) | On February 14, 2019, Mr. Nolan resigned from the Board of Directors of the Company. |

Attendance at Board and Committee Meetings and the Annual Meeting

The Board of Directors held eight11 meetings of the full Board during 2015. Each incumbent Director who was a Director in 20152018. In 2018, each of the directors attended at least 75% of the aggregate number of meetings of the full Board of Directors and relevant committees.committees held during the time such person was a director. The Company does not have a policy of requiring Directorsdirectors to attend the annual meeting of shareholders. The Company does, however, typically schedule a meeting of its Board of Directors the day before or close to the annual meeting of shareholders to facilitate each Director’sdirector’s attendance at the annual meetingmeeting. Six of shareholders. Of the ten members then on the Board, nineCompany’s non-executive directors attended the Company’s 20152018 annual meeting.

Executive Sessions without Management

To promote opencandid discussion among the non-management Directors,directors, the Board of Directors schedules regular executive sessions in which the non-management Directorsdirectors meet without management’s participation. Such sessions are scheduled totypically occur at every regularly scheduled Board and committee meeting. The ChairmanChair of the Board or the respective committee chairperson is the presiding Directordirector at suchthese executive sessions.

Audit and Finance Committee

The majority ofAll members of the Audit and Finance Committee are “audit committee financial experts” as defined in SEC regulations and all members are independent as defined under the NASDAQ listing standards. Pursuant to the Audit and Finance Committee’s charter, the Audit and Finance Committee assists the Board in its oversight of (1) the process of reporting the Company’s financial statements; (2) the system of internal controls as it relates to financial reporting;reporting and risk management; (3) the audit process; (4) the Company’s process for monitoring compliance with laws and regulations and codethe Code of conduct;Business Conduct and Ethics; (5) the review and approval of the Company’s declaration of dividends; and (6) the qualifications, independence and performance of the Company’s independent registered public accounting firm in accordance with SEC regulations. The Audit and Finance Committee is solely responsible for retaining the Company’s independent registered public accounting firm. The Audit and Finance Committee also conducts analysis and makes recommendations to the Board and management regarding the Company’s financial planning, capital structure, capital raising, proposed acquisitions, mergers and divestitures, overall strategic planning, and financial performance, whereas relevant.

Risk Management Committee

The Risk Management Committee’s responsibilities are described above under “Risk Oversight.”

Wealth Management/Trust and Investment Committee

The Wealth Management/Trust and Investment Committee provides strategic direction and oversight on behalf of both the Board of Directors and the board of directors of the Bank regarding the Company’s wealth management businesses, both in the registered investment advisory affiliates and in the Bank’s Trust division. The Committee assists the boards in analyzing the optimal means of enhancing the Company’s performance and expanding its acquisition and retention of private clients through these businesses. The Committee also assists the Bank in fulfilling its fiduciary responsibilities relating to the operation of trusts and the administration of fiduciary accounts. The Committee offers oversight and guidance to management relating to capital allocations and with respect to leveraging synergies within the wealth management business.

Compensation Governance and Executive Committee

The Compensation Governance and Executive Committee makes recommendations to the Board of Directors, where necessary, on certain matters including, but not limited to, changes to compensation plans and the adoption of new plans, and changes to the CEO’s compensation and changes to Board compensation programs of the Company. In addition, the Committee serves as the Executive Committee of the Bank’s board of directors.programs. The Compensation Governance and Executive Committee has been delegated the authority by the Board of Directors to approve compensation matters for all executive officers. Compensation decisions relating to the CEO are also reviewed and approved by the entire Board. For additional information on the Compensation Governance and Executive Committee’s process for the consideration and determination of the executive officer and director compensation, please see “Compensation Discussion and Analysis.”

Governance and Executive Committee

The Compensation, Governance and Executive Committee periodically reviews the arrangements for the overall governance of the Company by the Board of Directors and its committees and, among other things, assists the Board of Directors by evaluating the performance of the Board and its committees, identifies individuals qualified to become members of the Board, recommends the slate of candidates to be nominated for election to the Board of Directors and on the boards atboard of the Company’s subsidiaries where such membership is not otherwise mandated by contract,Bank, recommends the members and the chairs of the committees of the Board, adopts and implements governance practices and policies applicable to both the Company and its subsidiaries, and reviews and assesses the charters of all of the committees of the Board. In addition, the Committee serves as the Executive Committee of the Bank’s board of directors.

Consideration of Director Nominees

The Compensation, Governance and Executive Committee is responsible for identifying, assessing and recommending the slate of candidates to be nominated for election to the Board of Directors. The Compensation, Governance and Executive Committee uses a variety of methods for identifying and evaluating nominees for Director,director, and assesses the mix of skills and the performance of the Board as a whole on an annual basis. In the course of establishing the slate of nominees for Directordirector each year, the Compensation, Governance and Executive Committee will consider whether any vacancies on the Board are expected due to retirement or otherwise, the skills represented by retiring and continuing Directors,directors, and additional skills highlighted during the annual Board self-assessment process that could improve the overall quality and ability of the Board to carry out its function. In the event thatresponsibilities. When vacancies are anticipated or arise, the Compensation, Governance and Executive Committee considers various potential candidates for Director.director. Candidates may come to the attention of the Compensation, Governance

and Executive Committee through the business and other networks of the existing members of the Board or from management. The Compensation, Governance and Executive Committee may also solicit recommendations for Directordirector nominees from independent search firms or any other source it deems appropriate, and has most recently sourced non-incumbent candidates through the retention of such independent search firms and through the boards of its affiliates. When an incumbent Director is up for re-election, the Compensation,firms. The Governance and Executive Committee reviews the performance, skills and characteristics of suchall incumbent Directordirectors before making a determination to recommend that the full Board nominate him or her for re-election.

The Compensation, Governance and Executive Committee requires all nominees and candidates to possess the highest personal and professional ethics, integrity and values; to be committed to representing the long-term interests of our shareholders; to be able to devote theconsistently an appropriate amount of time to be consistently informed about the Company’s business and strategy, withstrategy; a balanced perspective, strong business and financial acumen; and thean ability to approach all decision making with a high level of

confidence and independence. In addition to reviewing a candidate’s background and accomplishments, candidates are reviewed in the context of the current composition of the Board of Directors and the Company’s evolving needs of the Company.

Following the 2015 annual meeting, the Board of Directors sought to recruit additional Board members whose qualifications aligned with the Company’s long-term strategy. After considering a number of candidates submitted by directors, management and a third-party search firm, the Board elected Ms. Zlatkus to the Board on July 1, 2015, and Ms. Stevenson to the Board on October 6, 2015.needs.

Pursuant to guidelinesthe Company's Corporate Governance Guidelines established by the Board, no more than two members of the Board may be executive members, and all others must meet the definition of “independent”an “independent director” under the NASDAQ listing standards. The Chief Executive OfficerCEO will always be a member of the Board. The Board of Directors elected Anthony DeChellis to the Board, effective as of November 26, 2018, when he became the Chief Executive Officer and President of the Company. Currently, the CEO is the only member of the Board who is not “independent”.independent. On an annual basis, the Compensation, Governance and Executive Committee reviews the “independent”independence status of each member of the Board to determine whether any relationship is inconsistent with a determination that the Director wasdirector is independent. The most recent review was undertaken in January 20162019 and, as a result, the Board, after such review, and recommendation by the Compensation, Governance and Executive Committee, determined that each of the Company’s non-executive directors (Mses. Kuenstner, Larson, Stevenson, Wells and Zlatkus, and Messrs. Morton, Nolan, ShapiroFurlong, Guyaux, Ubiñas and Waters) meets the qualifications for independence in accordance with the NASDAQ listing standards.

Directors of the Company are nominated in accordance with the Company’s by-laws,Bylaws, which provide that Directorsdirectors may be nominated (1) by a majority of the Board of Directors, or (2) by any holder of record of any shares of the capital stock of the Company entitled to vote at the annual meeting of shareholders. While the Compensation, Governance and Executive Committee does not have a formal policy regarding the consideration of any Directordirector candidates recommended by shareholders, such candidates recommended by a shareholder are evaluated on the same basis as candidates recommended from other sources. A shareholder wishing to nominate a Directordirector separately from the slate of Directorsdirectors nominated by the Company for the 20172020 annual meeting should follow the procedures described in this Proxy Statement under the heading “Submission of Shareholder Proposals for 20172020 Annual Meeting.” Any shareholder who seeks to make such a nomination for the 20172020 annual meeting must be present in person at such annual meeting.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics which applies to all of the Company’s and its subsidiaries’ employees, officers, and directors. In addition, the Company maintains procedures for the confidential, anonymous submission of any complaints or concerns about the Company, including complaints regarding accounting, internal accounting controls or auditing matters. Shareholders may access the Code of Business Conduct and Ethics in the Investor Relations/Corporate Information/Corporate Governance section ofby accessing the Company’s website at www.bostonprivatefinancial.comwww.bostonprivate.com., selecting the “Investor Relations” link at the bottom of the page, and then selecting “Corporate Governance” under “Governance.”

Shareholders’ Communications with the Board of Directors

Shareholders wishing to communicate with the Company’s Board of Directors should address their communications toemail the Company’s investor relations department by email at investor-relations@bostonprivate.com, by telephone atcall 888-666-1363 or by mail sent to the Company’s main address at Ten Post Office Square, Boston, Massachusetts 02109, Attention: Investor Relations. The mailing envelope should contain a clear notation indicating that the enclosed letter is a “Shareholder-Board Communication” or “Shareholder-Director Communication.” All such letters should clearly state whether the intended recipients are all members of the Board or certain specified individual Directors.directors. All communications will be reviewed by the Company’s investor relations department, which will determine whether the communication will be relayed to the Board or the Director.director. Except for resumes, sales and marketing communications or notices regarding seminars or conferences, summaries of all shareholder communications will be provided to the Board.

INFORMATION REGARDING EXECUTIVE OFFICERS

The following table lists the name, age and current position of each executive officer of the Company.

|

| | | | | |

| Name | | Age | | Current Position |

Margaret W. ChambersMaura S. Almy | | 5653 |

| | Executive Vice President General Counsel and Corporate SecretaryChief Operating and Platform Officer of the Company and the Bank |

Clayton G. DeutschAnthony DeChellis | | 6056 |

| | Chief Executive Officer and President of the Company and the Bank |

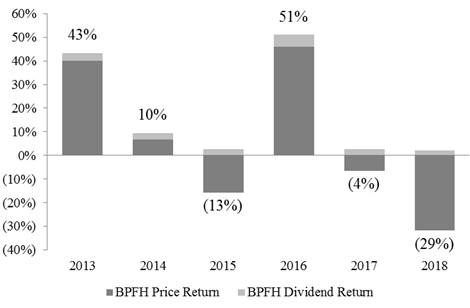

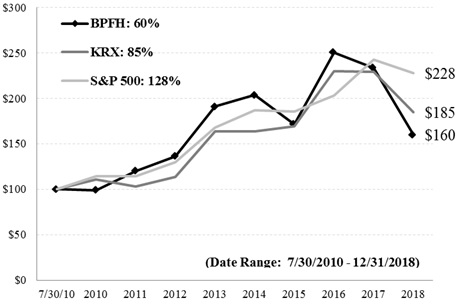

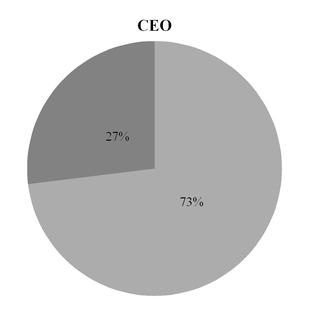

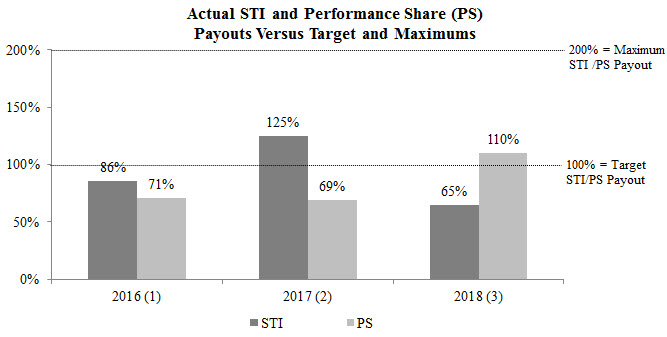

| Steven M. Gaven | | 39 |